By any other name would smell as sweet.” – William Shakespeare

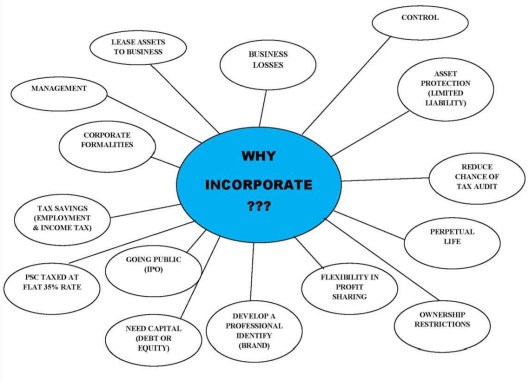

Why would you NOT incorporate?

Yesterday, I asked you why you would incorporate. Today, we will examine why some businesses opt to form a partnership or LLC in lieu of a corporation. What’s in a name? Well, if there are two or more people involved in this entity, the question will likely be – nothing! But beware of the default button!

Who’s on first – partners or members?

Education:

Partnerships

A partnership is the relationship existing between two or more persons who join to carry on a trade or business. Each person contributes money, property, labor or skill, and expects to share in the profits and losses of the business.

Types of Partnerships

1. General Partnership (GP) – Beyond the scope of this lesson

2. Limited Partnership (LP) – Beyond the scope of this lesson

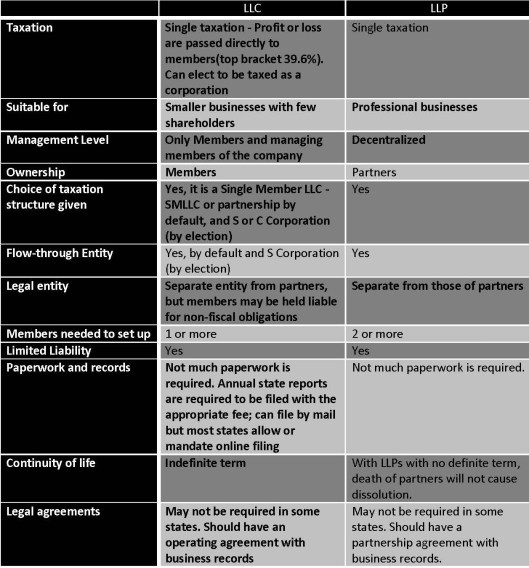

3. Limited Liability Partnership (LLP) – See comparison chart below

4. Family Limited Partnership (FLP) – To be discussed in a future lesson

Limited Liability Company

A Limited Liability Company or LLC is a figment of your imagination. Well, sort of! Let me explain. Did you know that the Internal Revenue Service (IRS) does not recognize the LLC as an entity form? That’s a great bit of trivia to try out at the next cocktail party. No, the LLC is a function of state law, which simply means that it was created and envisioned by the state. As a result, you must apply to be an LLC with the Department of State in your jurisdiction. Formally, an LLC is a hybrid business organization that mixes the best of corporations, partnerships, and sole proprietorships. This legal structure offers the greatest level of flexibility and is a preferred structure for certain industries.

Types of Limited Liability Companies

1. Single Member LLC

2. Multi-Member LLC (partnership by default, and S or C Corporation (by election)

We just scratched the surface of this fairly complicated area of tax law. There are many more characteristics that differentiate the LLC from the partnership, including the preferred structure based on your industry. However, discussion that is beyond the scope of this lesson.

For more information or a free consultation of Entity Choice, visit me at http://www.kmsykescpa.com.

Resources:

• Legalzoom.com – Find resources and information to set up your partnership or LLC.

Important term!s from this lesson:

Action Step: Watch and learn.

Posted by kenyasykes | Filed under Basic Personal Finance