Mo Money, Mo Problems

No Money, Real Problem

Do you have the capital to start your business?

For most aspiring business owners, the answer to this questions is usually no. Sure, there are some who will pursue entrepreneurship after a successful career in another area where they were able to build a war chest to use to fund their new dream. But, for most aspiring business owners, there is no war chest available. So what now? Well, since you don’t own a money tree, you need to learn about the options available to you.

Education:

One of the most critical factors to the success of any business is access to capital. Capital refers to financial resources available for use. Capital is different from money. Money is used simply to purchase goods and services for consumption. Capital is more durable and is used to generate wealth through investment. In this case, the investment is a business.

In today’s lesson, we will continue discussing the merits of business owners as a path to wealth. In Lesson #59, I introduced the business plan. One of the purposes of a business plan is to provide a document of your capital needs. Once you have an idea of the amount of capital that you will need to get started, the next step is to – find the money.

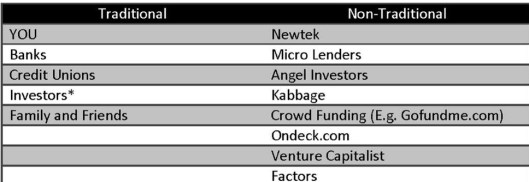

There are many ways to raise capital – traditional sources and non-traditional sources. The chart below lists the sources that are currently available to aspiring and established business owners.

*Beware – Investors are not free!

Common Misconception about SBA Loans

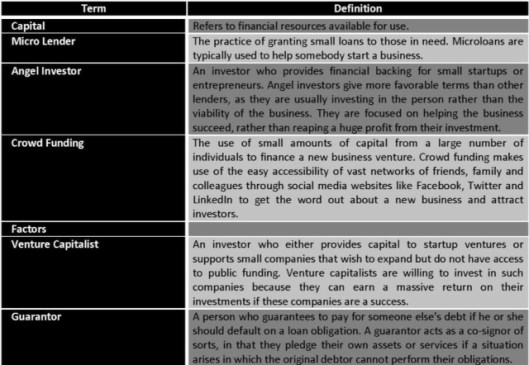

One common misconception is the you can get a loan from the Small Business Administration (SBA). Let’s be clear, the SBA is not a lender and does not lend money. The SBA is a guarantor, which means that they guarantee loans (up to a limit) made by other approved lenders. Access to capital is the bedrock of business growth and viability. From the ability to satisfy working capital needs, to expansion, to exploring new business opportunities, to hiring employees, the availability of capital is the predictor of the business’ ability to thrive. Use the chart to learn about the different financing options available to you.

Resources:

Newtek (thesba.com) – The Small Business Authority offers SB loans from $50,000 to $10 million.

Kabbage.com – Kabbage provides working capital to small businesses. From online sellers to brick and mortar stores, Kabbage services every type of small business. Banks take weeks to decide on an advance and merchant cash advance companies take days. Kabbage delivers funds in 7 minutes.

Ondeck.com – Ondeck delivers small business loans using the OnDeck Score™ technology,

which focuses on the health of your business – not your personal credit score.

Important terms from this lesson:

Action Step: Go through the chart of Traditional vs. Non-traditional sources and find out which option works best for you. Refer to the Resources and Important Terms sections for assistance.