Why would your incorporate?

The answer to this question is usually – “because someone told me to”. Choosing the right legal structure for your business is the most important question that a new business owner must answer. This is an area where many costly mistakes are made by business owners and some overzealous tax preparers, who are not well versed in this area. When determining which legal structure makes the most sense for you, it is important to understand the tax and nontax factors to consider when making your decision.

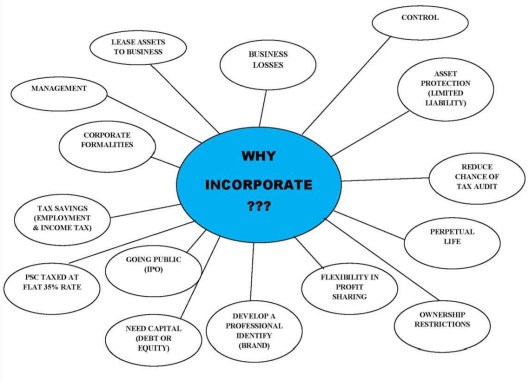

About four years ago, I created this diagram as a discussion piece for a lecture to a class of aspiring entrepreneurs. Of course, this chart was like hieroglyphics to them because they had no idea that there were so many factors to consider when starting a business. Today, we will discuss the merits of operating your business as a corporation.

Education:

A Corporation is a legal entity that is separate and distinct from its owners. Corporations enjoy most of the rights and responsibilities that an individual possesses; that is, a corporation has the right to enter into contracts, loan and borrow money, sue and be sued, hire employees, own assets and pay taxes. The most important aspect of a corporation is limited liability. That is, shareholders have the right to participate in the profits, through dividends and/or the appreciation of stock, but are not held personally liable for the company’s debts.

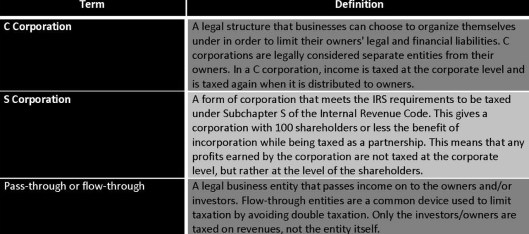

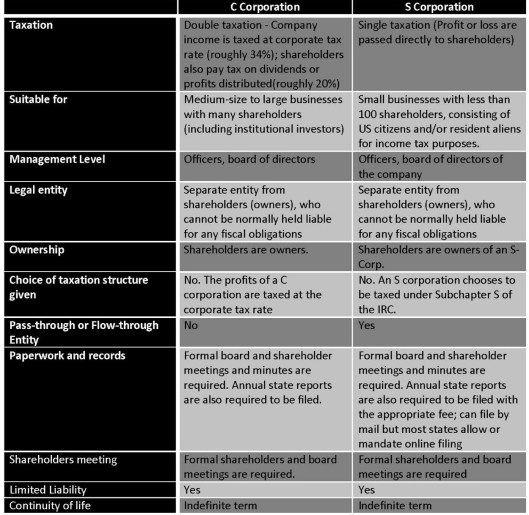

There are two types of corporations: “C Corporations” and “S Corporations”. The moniker comes from the section of the Internal Revenue Code which governs the legal business entity – Subchapter C or Subchapter S of the 1986 Code.

C or S Corporation choice is critical for small business. This choice is of C vs. S status is all about taxes. By default, when a business formally incorporates, it becomes a C Corporation. The S Status is a special category reserved for eligible businesses where they can elect to be taxed the same as an LLC or partnership. In other words, the S status gives a corporation the opportunity to be taxed as a “pass-through or flow-through” entity is a legal business entity that passes income on to the owners and/or investors. Flow-through entities are a common device used to limit taxation by avoiding double taxation. Only the investors/owners are taxed on revenues, not the entity itself. The chart below shows some of the differences between the two types of corporations.

There are additional nuances to the C vs. S Conuudrum that are beyond the scope of this lesson. In the next lesson, we will discuss the LLC vs. the Partnership as the final legal business structure options available to business owners.

Resources:

• The Company Corporation (www.incorporate.com) – Find resources and information to incorporate your business.

Important term!s from this lesson: