“Life is like a box of chocolates, you never know what you’re gonna get. “ –Forrest Gump  Eureka! Forrest Gump was on to something when he uttered one of the most famous movie quotes in history.

Eureka! Forrest Gump was on to something when he uttered one of the most famous movie quotes in history.

On Friday, we celebrated Valentine’s Day and I commemorated the occasion by giving my partner a large heart-shaped box of chocolates. Because the box was so large, four days later, we are still enjoying those bite-sized edible rays of joy. Upon removing the lid, all that is visible to the eye is the shape of the chocolate. Because we lack the x-ray vision of Superman, the only way to know what is on the inside of the chocolate, the filling (e.g. nougat, almonds, caramel, etc.) is to examine the map that is included in the box, a cheat sheet of sorts which tells you exactly what is in each chocolate. Although they appear similar to the naked eye, each chocolate has its own characteristics. Some are made of dark chocolate, some of milk chocolate, some contain nuts, some do not and so on. Using this map, my partner knew to steer clear of caramel because she hates it. However, I love caramel, so I used the map to zero in on my favorite filling.

If I can take a few liberties with Mr. Gump’s quote, I would say that Mutual Funds are like a box of chocolates, however, the map tells you exactly what you are going to get. In the world of mutual funds, this map is called a prospectus.

Education:

In Lesson #28, we began our discussion of mutual funds and how they can be used to give a small investor the purchasing power or wherewithal of a large investor. In this lesson, we will discuss how to pick the right chocolate!

A prospectus, is the map that teaches what each chocolate contains. It is absolutely critical that you read a prospectus before investing in a mutual fund. Would you eat a chocolate with almonds if you were allergic to nuts? Maybe…if you didn’t know, but would you take the risk? The prospectus gives you all of the information about the mutual fund, including the following.

- What shareholder services is available in the fund

- Distribution information

- Tax information

- Fees and expenses *

- Performance results

- The investment goals of the fund

- The investment holdings

Of the seven items listed above, the most important items to understand are the fees and expenses. For Mutual Funds, so

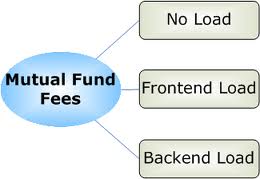

- Load Fees (Front-end, No Load or Backend Load)

- Contingent (CDSL)

- 12b-1 fee

- Management Fees

- Redemption Fees

Example: If you invest $10 and the investment earns $5, then you would think that you $15, right? Wrong, read the fine print.

Mutual Fund fees can turn your potential $15 into $3 without using magic. BEWARE OF FEES!

ALWAYS READ THE PROSPECTUS!

Resources:

FINRA (http://www.finra.org/ ) – The Financial Industry Regulatory Authority is an independent, not-for-profit organization authorized by Congress to protect America’s investors by making sure the securities industry operates fairly and honestly.

Important terms from this lesson:

|

Term |

Definition |

| Prospectus | A document that contain the facts that an investor needs to make an informed investment decision. |

| Front-end Sales Load | A type of fee that investors pay when they purchase fund shares. |

| No Load Fund | A mutual fund in which shares are sold without a commission or sales charge. |

| Backend Sales Load | A type of fee that investors pay when they sell fund shares. |

| Contingent (CDSL) Fees | A type of fee that investors pay only when they redeem fund shares |

| 12b-1 fee | An annual fee paid by the fund for distribution and/or shareholder services |

Action Step: Watch the animated video and learn about mutual fund fees.